For many of us, retirement is one of the most important decisions we make. From both financial and personal view, planning for a comfortable retirement is a time consuming and extensive process that takes planning and persistence. Managing your retirement income plan is an ongoing process that lasts throughout your life.

While all of us would like to retire comfortably, the complexity and time required to build a successful retirement plan can make the whole process seem daunting. However, it can often be done with fewer headaches than you might think—what it takes is some homework, an understanding of the risks, and knowledge of how to attempt to mitigate the risk.

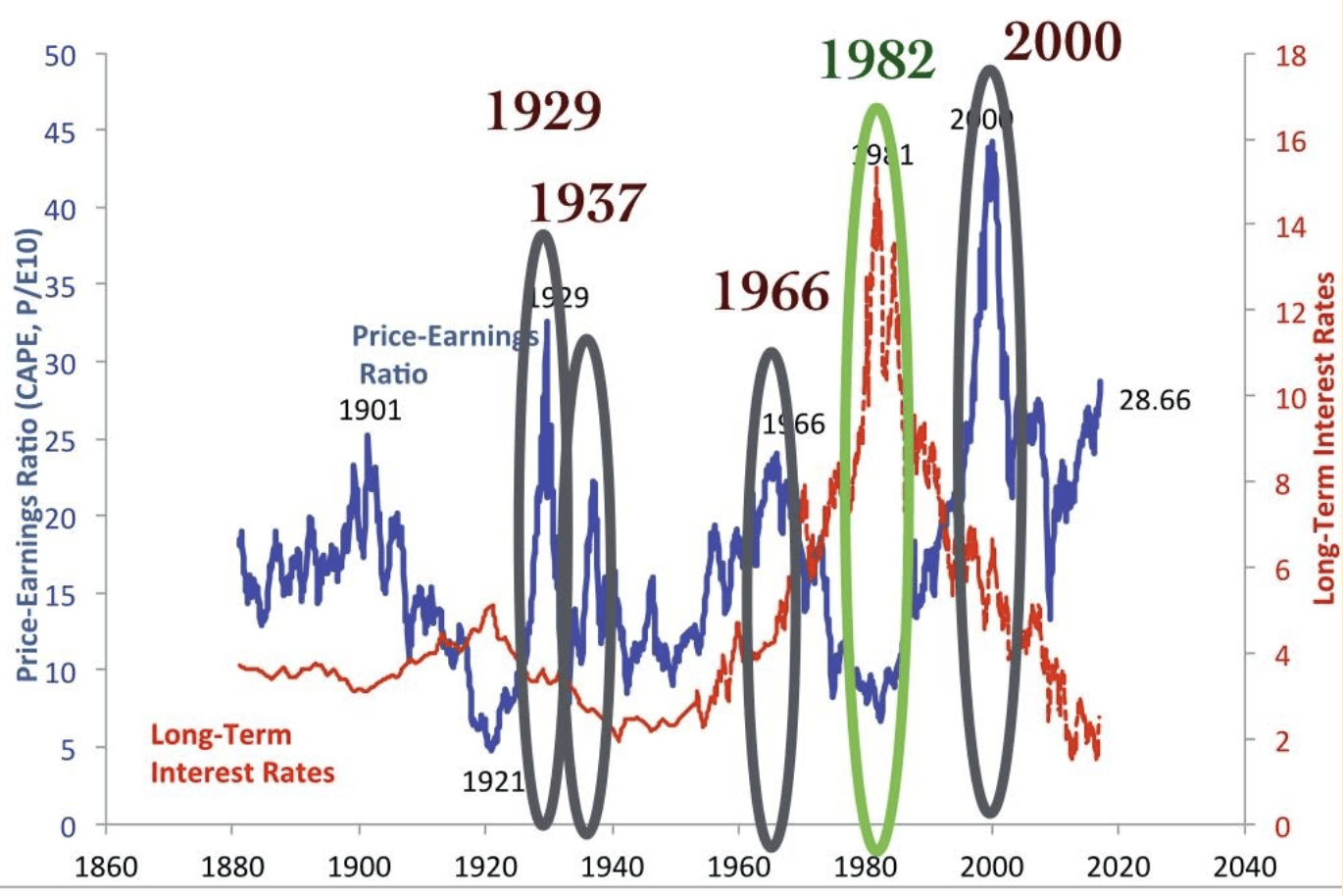

Safe Harbor Retirement Planners understands the current economic climate is challenging for retirement planning. History tells a story and it’s critical to listen. Federal Treasury Rates are historically very low.¹ Factors like this have sometimes led to challenging times to retire in the history of the U.S. Hence the 4% rule.

Here is a quick introduction to the 4% rule: The 4% rule is a general guide to how much money a retiree can withdraw from their portfolio and still theoretically never need to worry about running out of money. For example, a couple retiring with $1 million can withdrawal $40,000 (4%) in the first year of retirement. This research was conducted using historical data based on the U.S. Stock market and interest rates. Under the worst-case scenario, withdrawing 4% of your money to use in retirement has a 100% success rate under every market condition. In fact, there were only three periods when 4% would have been the most a retiree could spend. This was in 1929, 1937, and 1966. Each date is circled in gray on the above chart. Take notice to the clear relationship between the Stock Market valuation and interest rates. The chart shows us the most challenging economic time periods for retirees is when the stock market is highly valued paired with low interest rates.* Click here if you are interested in reading the full study conducted by William Bengen.

* https://www.thebalance.com/dont-confuse-these-two-retirement-rules-of-thumb-453920

Also, it’s important to note, the green circle represents the historical date that represented the best possible time to retiree. During this period the opposite relationship exist. Interest rates are very high paired with a low stock market valuation. In fact, a retiree would have been successful withdrawing over 10% of their portfolio over 30 years, if they had retired in 1982. That means a family starting retirement with a $500,000 portfolio in 1982 would have produced more inflation adjusted income than a $1,000,000 portfolio in 1966. Only a 16-year difference!

Risk could be high!

- Because risk could be high when you retire, it might be critical to dial back the potential volatility associated with a stock heavy portfolio (sequence of returns risk). Here lies the problem. Many low volatile (safe) investments are currently offering meager returns. Think CDs, U.S. Treasuries, High-rated bonds. Each of these offer very low interest (yield). Thanks to the low interest rate environment.

- We provide a solution, and it begins with the strategic design of our advisory platform.

- We have created our firms to be independent—without ties to any one investment or insurance company. This independence gives us the advantage of having many options available to help our clients.

- With access to many potential strategies, Safe Harbor Retirement Planners carefully selects investment / insurance instruments that are in our client’s best interest.

- Since growth without risk is a large priority for clients, we attempt to implement strategies that provide guaranteed principal protection from insurance carriers for a calculated portion of the portfolio.

- We find strategies that provide the greatest amount of growth potential while taking the least amount of risk.

- Due to the importance of avoiding significant losses in the early stages of retirement (sequence of returns risk), our retirement income planning strategies allow for a predictable income stream, even in extended depressed economic periods. We have tested our strategies under the worst market conditions in history.

Safe Harbor Retirement Planners is structured to allow the independence required to give you access to superior investment options, providing you advice that is in your best interest, for the sole purpose of structuring a sound retirement income plan.

1 | Yun Li Imbert Fred, “10-Year Treasury Yield Collapses to Another Record Low of 1.16%, 2-Year Rate Tumbles below 1%,” CNBC, February 28, 2020, https://www.cnbc.com/2020/02/28/10-year-treasury-yield-falls-to-new-record-low-amid-coronavirus-fears.html.